Jan Dhan is probably the most aggressive scheme undertaken by any government for financial inclusion. Between December 2014 and December 2016, the number of accounts increased from 104 million to 262 million and further to 288 million by May 2017. However, the challenge is to get people to use these accounts and get into the banking habit, so that they could move up the ladder and use a credit facility or remittance or third-party product offered by banks. How successful has this scheme been?

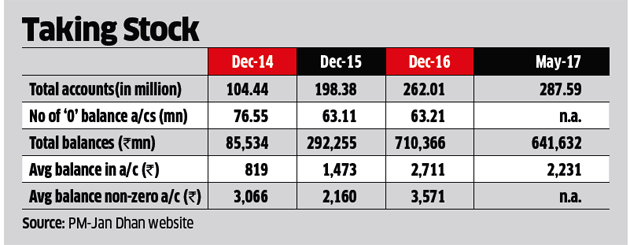

The thrust was on numbers to begin with and, hence, having 288 million accounts indicate that virtually every family has access to an account. The average balance held in these accounts, however, is critical as it indicates whether or not the banking habit has been cultivated. The table here provides some data on these accounts, with focus on non-zero balance accounts (information up to February 2017 only). Comparable numbers for average balance in all accounts are also provided to give a perspective. ..

In terms of the use of these accounts, some interesting facts emerge. First, the average balance kept in these accounts increased and peaked in December 2016. The higher usage of these accounts may be attributed to demonetisation as several transfers were made – both by households as well as those stocking black money for conversion purposes. Still the amount was just about 22 days of NREGA wages. Second, post-demonetisation the money appears to have been withdrawn by around Rs 500 per account. ..

How high are these average balances? Prior to the introduction of this scheme, RBI data on average size of deposits as of March 2014 shows that in rural areas, it was Rs 11,080/account, which rose to Rs 17,251 in semi-urban areas and Rs 36,056 in metro and urban areas. The average for the country was Rs 21,156/account. Two conclusions may be drawn here. The first is that the Indian banking system was doing an excellent job in terms of garnering funds from the business perspective and covered hou ..

The interesting part of these accounts is that it has primarily been an initiative shown by the public sector banks with their share being around 80%, followed by regional rural banks with 16-18%. Both have borne the cost of this scheme. Private sector banks have averaged around 3.2-3.5%. The leading states are UP, Bihar, West Bengal, Maharashtra, Manipur, Rajasthan, Chhattisgarh, Assam and Odisha.

A thought worth pondering over is that if PSBs in the normal course were doing a good job of coverage and Jan Dhan has acted more as a channel for government transfers, the addition of small banks and payments banks would only make the canvas more competitive with each segment fighting for a limited piece. It does appear that we may have reached the end of the road where improvement can accrue only if incomes increase and having more institutions and schemes may not add a significant delta to th ..

Read more at:

/

/

No comments:

Post a Comment