https://www.youtube.com/watch?v=pvDVyqV0Avc

Thursday, March 31, 2022

Sunday, March 27, 2022

The Son way to rise | Book review: ‘Aiming High: Masayoshi Son, Softbank Group and Disrupting Silicon Valley’ by Atsuo Inoue: Book review Financial Express 27th March 2022

In business, it has been observed that there are three main types of entrepreneurs. The first are those who come from business families and are able to scale up operations and create extraordinary value through agility and innovation. They evidently have an initial advantage. The second set are well qualified persons who have the pedigree of the right university degree and are able to break out from the traditional mould of working for others and start enterprises from scratch and make a mark. Here, too, there is an advantage of background as they often come from upper middle-class families but no traditional backing.

The third are those who do not have such advantages and are what would be called commoners and who rise from the bottom and ascend to the top. When one looks at Masayoshi Son, the profile falls in the third category.

Aiming High is an interesting story of the founder of SoftBank and in many ways resembles stories of other successful entrepreneurs who have risen from the ground. A Korean by descent and raised in Japan as an immigrant, Son went to the USA and started a life of enterprise dealing in voice translators. He was driven by ambition and had a large capacity for risk taking. In fact, as a college student, he earned his first million dollars for the invention of an automatic voice translator.

The author, Inoue, has followed Son and his life for several years and has spoken with several persons associated with his life, including friends and partners, to put together this rather inspiring book. It tells us everything about the man and his business acumen and also about his failures and successes.

The book not just talks about his remarkable risk-taking ability, but also how he wooed his future wife. Hard work is what he attributes his success to, which, ironically, is also reflected in the fact that he turned up late for his own wedding! Never afraid of failure, Son also survived chronic hepatitis. Having written a 50-year life plan to build his destiny, he can be proud of his achievements now in his mid-sixties.

He was quick to spot opportunities in the Internet and smartphone revolutions. He was able to pick up Vodafone Japan and Sprint mobile phone businesses and also invested heavily in Alibaba. His Vision Fund is focused on the AI revolution and invested in more than 150 tech companies, putting in more capital than it needed. His belief in AI is 100% as he believes that it is the most incredible thing humans have ever made. Masayoshi Son can be called the most powerful person in Silicon Valley, having invested in some of the most exciting and influential tech companies like Uber, WeWork, ByteDance, Slack, and many others.

Son’s career trajectory is a testament to the virtues of good planning and sticking to it. The first phase in the twenties was to create a company, and the product or service did not matter. One would make a name by doing so. Phase two was to amass a war chest of 100 billion yen, which lots of critics would say was delusional. Third was that when in the forties he would challenge a big company for dominance. In in his fifties and sixties he had to be certain that the business was a success before passing on the mantle to the next generation. Based on this plan, one cannot refute the fact that Son has stuck to the task.

The one winning point for Son in his journey was the ability to invent and also have the courage to implement his ideas. Son believed that there were three main approaches to invention. First was searching for solutions to problems. Like how the idea of making square-shaped pencils came from the fact that rounded ones tended to roll off the table. A simple solution for an irritating problem.

The second was lateral thinking or looking at things from the opposite perspective. Turn something around and make it square was his dictum. Make what has traditionally been red look white. Or make something big, small. For traffic signals his solution was to throw in geometric designs into the mix and hence triangles, squares and circles were thrown into signals so that colour blind people could tell which phase of light was on.

Last was to combine pre-existing things and keep things simple. Like taking a radio and tape recorder and putting them together to make a radio cassette player. Most of his inventions came in the third category, which worked well in the USA.

This book can be inspiring for someone keen to be innovative, though admittedly every story would not always play out this way.

Aiming High: Masayoshi Son, Softbank Group and Disrupting Silicon Valley

Atsuo Inoue

Hachette

Pp 338, Rs 599

Thursday, March 24, 2022

Green bonds, digital currency hold promise: Indian Express 24th March 2022

https://indianexpress.com/article/opinion/columns/lic-ipo-green-bonds-digital-currency-hold-promise-7833419/

Monday, March 21, 2022

Should we rework the Budget numbers now? Business Line 21st April 2022

Managing a budget of an economy as complex as India is always challenging as the projections go awry often because there are too many extraneous elements which come into the fray, upsetting calculations. The government had sought approval from the Lok Sabha with a third supplementary demand for grants under the force of circumstance for FY22 in March.

As volatile economic conditions are likely to continue until such time that the war ends, the assumptions made when drawing up the budget for FY23 must be revisited and probably revised given the evolving conditions.

Disinvestment blues

The most obvious issue is disinvestment. The LIC disinvestment has been postponed because of the uncertain geo-political conditions. But the war is still on and while the DRHP filing has gone through with approvals, the same would hold till May, by which time the war may not have ended. Hence if disinvesting LIC was not appropriate in March it may not be so in May which in turn means that there will have to be a fresh submission.

Also if the target was say ₹65,000 crore which will be rolled over to next year, it will be hard to do an additional ₹65,000 crore which was targeted in the Budget for FY23.

The other big worry is on the price front where global commodities are witnessing a bull run for the second time not due to buoyancy in the world economy but due to severe disruptions which started from oil and has moved to other commodities as sanctions against Russia begin to bite.

The Budget did not conjecture that the crude oil price would increase to the present levels and went by the assumption of $70-75/barrel. The price had scaled past the $130-140 mark but has reverted to less than $100 mark. But one can never say where it would go in the coming months as the war does not seem to be ending anytime soon.

The government is under pressure to take some action on the price front. So far, the retail prices of fuel have remain unaltered with the OMCs bearing the additional cost. But soon the four players in the fuel market — Centre, States, OMCs and consumer — will have to share the cost of fuel increase unless the price goes back to the $70-80 range which looks unlikely.

So the government will have to cut back on its excise collections in case the excise rate is reduced. It was already lowered by ₹10/litre for petrol and ₹5/litre for diesel in November 2021.

The same problem percolates to the fertiliser segment. Last year the government had to increase the subsidy on fertilisers through the supplementary demand just as the second wave of Covid hit us.

However, the same was cut back by around ₹25,000 crore for FY23 from the revised number of ₹1.40 lakh crore for FY22 (which will now go up as per the third supplementary demand by another ₹15,000 crore). Higher oil and gas cost feed into fertiliser prices and the government cannot risk leaving things unattended as that can increase farming costs and add to inflation.

Today with the exception of edible oils, food inflation has largely been under control with good harvests barring seasonal shocks in horticulture. With core inflation being high, unchecked fertiliser prices has the potential of increasing prices of all farm products. Hence the subsidy element would have to be relooked.

The other area on the expenditure side is capex. There has been an announcement of a sharp increase in capex for FY23 to ₹7.5 lakh crore from a revised number of ₹6.03 lakh crore in FY22. With commodity prices increasing steadily especially of metals, the effective cost of projects that have been included in the budgetary plans would tend to increase. Therefore, the government may have to decide between two alternatives.

Two alternatives

The first is to retain the outlay at ₹7.5 lakh crore but reduce the number of projects. The alternative would be to scale up for cost escalation, which can be between 5-10 per cent, given the increase in global commodity prices. This would also increase the fiscal expenditure part and with possible lower revenue can stress the deficit.

Another area where the government has been deploying funds is housing. Here the third supplementary grant has asked for around ₹30,000 crore for the subsidy component under the PM Awas Yojana. This increases the effective outlay from around ₹74,000 crore to ₹1.04 lakh crore. For FY23 the government had included a sum of ₹76,000 crore. Here too the government may have to take a call on whether it would be in a position to lower the allocation as per the Budget. It may be necessary to increase the allocation for the same.

Under these unusual circumstances the government should rework the budgetary numbers for FY23 and put out realistic revised estimates even before the new fiscal starts. This will also prepare the market better which is already guessing what the final outcome would be in terms of borrowing for the government.

In FY22 presumably there will be no additional borrowing as the government has cut back on certain expenditures while allowing for other additional expenses in certain targeted fields.

Also the government can also consider whether or not under these extenuating conditions there is a justification to stick to the 6.4 per cent fiscal deficit number. In fact there is a strong reason to rework the numbers on the basis of the assumption of 11.1 per cent nominal GDP growth that was assumed in the Budget being very conservative.

With the present scenario pointing to real growth of 7.5 per cent or so and the inflation deflator being in the 6 per cent region, a nominal growth rate of 13 per cent would be reasonable. This can be the base of all the conjectures on tax collections.

As these would be higher than assumed, there could be some flexibility provided to the government on the revenue side which in turn can accommodate the higher expenditure.

Thursday, March 17, 2022

Russia-Ukraine war: What if fuel prices are corrected now? Free Press Journal 17th March 2022

The present war in Ukraine has meant one thing for sure. We all have to suffer more on account of commodity prices going up with the impact being direct for petrol and diesel.

The issue is that even before the warlike situation began, there was a case for the government to naturally increase these prices because of higher global crude prices. These hikes were held back because of the State Elections that were to be held in February and March.

As was the case last year, once the results were announced, prices were increased. Why should it be any different this time? The government earns a lot of revenue from excise and VAT on these two fuel products. In Fy21 for instance, the centre picked up Rs 4.20 lakh crore while the states got Rs 2.17 lakh crore. In fact, this is one reason the government is not willing to include them under GST.

The centre in November did lower the excise duty rate by Rs. 10 on petrol and Rs. 5 on diesel. This was a reversion to the pre-pandemic times. Since November, the price of petrol has remained unchanged in Mumbai at Rs. 109/litre approximately.

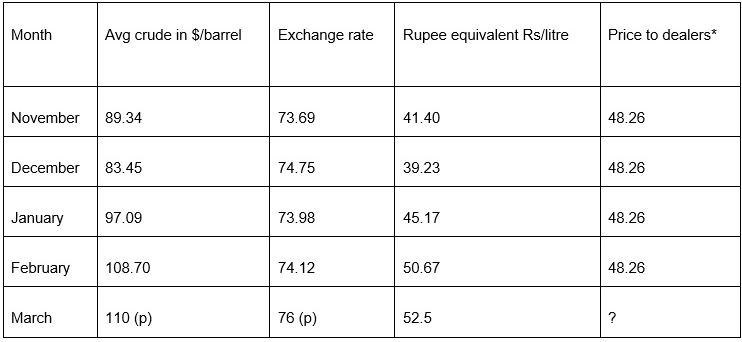

Now given that the price of the Indian crude basket has gone up from $ 89.34/barrel in November to say $ 110/barrel in March if not more; what would be the price of petrol under unchanged conditions?

This would mean that the excise rate remains at Rs 27.90/litre as does the commission at Rs 3.77/litre and the effective VAT of 37.5% in Mumbai. Russia is the third-largest producer and supplier of oil and any ban on imports will affect overall supply as the other nations cannot provide around 11 mn barrels a day which is what comes from here. US and UK have spoken of such a ban.

The table below gives the price of crude oil, exchange rate, price to dealers for the last 4 months. The same is projected for March under the new conditions:

P: Projected *: Cost held constant as the burden has been taken on by OMCs. The price to dealers should ideally have been Rs. 6.86 higher than the rupee equivalent in the table which is the refining cost calculated as the difference between the rupee equivalent of crude price and the price to dealers. Based on this, the cost per litre would work out to the following:

The table shows that if the price of crude remains at $ 110 for March and the Rs/$ rate at 76, the cost to the producer will increase from Rs 48.26 to Rs 59.36/litre which is an increase of around Rs. 11.

The centre’s excise rate is a specific duty and the call has to be taken on whether to lower it further. Presently, the state VAT is around Rs. 30.80 which will increase by around 10%.

Which of the two governments will cut their tax rates? The centre is already in a quandary as the disinvestment programme will probably not be advanced this month given the market conditions. Therefore, there will be a deferment of the same next year for which Rs. 65,000 crore has been separately budgeted assuming that LIC would happen in FY22.

The market will not be prepared for Rs. 1.3 lakh crore of disinvestment next year and hence the move has to be calibrated. The centre has already budgeted for a lower collection on the excise front which is charged mainly on fuel products.

This was lower than FY22 by Rs. 60,000 crore as the duty was cut on fuel in FY22 itself. Any further reduction in duty will widen the revenue-expenditure gap further.

The states too have a tough job balancing their budgets and with the GST shortfalls being there for two successive years and the uncertainty of the compensation post FY22 when the GST had given the assurance, any cut in VAT here will pressure their budgets further.

Therefore, this will be a very tough call to take by the government. States which have a more comfortable position in terms of fiscal space may be in apposition to lower the VATrates but this will help to lower the overall price, which will still remain above the current levels.

If the taxes are not touched,then the price of fuel will rise which will be inflationary not just from the point of view of the fuel component but also freight rates which will in turn then find their way through other commodity prices thus leading to generalized inflation. If the same is absorbed by the OMCs, then the government has to be prepared for lower dividends from these companies.

Therefore,it will be interesting to see how the two governments respond post the State Elections assuming that the crude oil prices remain in this elevated range.

Tuesday, March 15, 2022

We must correct the IPO pricing of startups with no profit record " Mint 15th March 2022

The initial public offering (IPO) boom this fiscal year has been quite

amazing. There have been 181 issues of ₹1.64 trillion in

the first 9 months of the year as companies raised funds ostensibly for

investment purposes. As is the case with any boom in financial markets, the

regulator’s antenna goes up.

The use of funds was the first issue addressed by the Securities and

Exchange Board of India (Sebi); we now have guidelines to ensure that there is

no diversion of money raised. The other nagging issue was that almost half the

issues had quoted at a discount post listing, which is a concern as several

small investors have burnt their fingers. Should the regulator be concerned

about this?

The broader question is whether issuers with records of losses for three

successive years are pricing their IPOs appropriately. As a corollary, are

investors being taken for a ride by merchant banks that have priced companies

which are making relentless losses favourably based on some imaginary future

turnover and profit numbers?

For a listed company, a share issue is transparent enough. The past can

be researched before one decides whether or not the price is right. However,

for several first-time issuers, which include startups, we have no past record.

Companies that have made losses in the past three years cannot show

performance. But they have dreams that could look like reality to investors if

presented well by merchant bankers and spiced up with media interviews that

make startup stories so appealing that their offer prices could be ridiculously

high. This is where the regulator has a role to play.

Ever since the Controller of Capital Issues was abolished and free

pricing allowed of shares, it was the market that decided pricing. Startups,

however, are an enigma. They are mostly technology- driven, sell ideas in a

non-conventional manner, and loosely speaking do not have fixed assets to show.

They typically begin with venture capital (VC) investment. Losses pile up so

high that a conventional business with such a record would close down. But

these enterprises are sold to various private equity (PE) investors who find

value in the enterprise, and hence their shares change hands. Originators often

either move out of the business or start another venture. But they have made

their money by getting a good valuation. The transaction however remains B-2-B,

one with high net worth individuals operating through VC or PE funds. There is

inherently no threat of market disruption.

Now, conditions have changed. The government has given an impetus to

startups through an initiative that provides initial access to funds at a low

rate. Startups are supposed to generate entrepreneurs and also employment.

Therefore, several bright engineers and management graduates set up enterprises

that sound good but can’t generate profits in the medium run. The best way out

if one cannot find an investor is to go for an IPO.

The valuation is now left to an investment bank, which comes up with a

number based on expected future performance. This is accepted by investors when

the stock market is in a bull phase and not surprisingly gets over-subscribed.

Conventional metrics like earnings-per-share, price-equity ratio and

return-on-net-worth cannot be applied, as these are loss-making businesses. The

market is not always lenient, however, and that is why some of these issues

fail at the time of listing.

Sebi has rightly

pointed out that there has to be more transparency in the valuation process and

we need to have certain key performance indicators (KPI) that must be revealed.

But what can these be, given that conventional financial parameters will never

work for a consistently loss-making business? Here, maybe we should look at the

history of the promoters in other ventures. But first-time entrepreneurs would

be hard to evaluate this way.

Using a past valuation if there has been a transfer of ownership in the

past is another option. But what if this was overstated to begin with? Making

comparisons with startups in other geographies may again not be appropriate, as

conditions vary especially for such enterprises. For example, the prospects of

say a food-delivery service in India will vary from one in China or South

Africa. Therefore, drawing such similarities will be tough.

One way out it to cap offer prices. The advantage here is that the

market will finally decide the price, which will help investors in case there

is a price rise post listing; but the promoter will feel let down as the cap

would have worked against enterprise.

Another solution can be that a loss-making company issues shares in

tranches. The first one could have a price cap. But after a gap of one year

once the stock is listed, a second tranche can be raised the standard way

without regulatory intervention as investors would by then have the company’s

share price history to judge it.

Alternatively, a valuation should be done by Sebi-appointed agencies

independently, with the price being revealed to the regulator separately. The

advantage is that it will be an independent view and hence the conflict of

interest that exists between the merchant bank and its client will be lowered.

This seems like a plausible solution because the number of loss-making

companies getting listed will not be too high. The issuance cost will be high

for such a startup, but then, given the premium being demanded, it can be

absorbed.

The third option would be to hold the proceeds in an escrow account,

with the money released to promoters on the condition that projections made by

the merchant bank while evaluating their business materializes, with space for

a certain degree of deviation from those numbers. This will make IPO pricing

more realistic.

Sebi’s discussion paper on the matter is timely, given a new situation

of loss-making companies making merry at the expense of investors. Globally

too, it has been found that 80% of startups fail. With overpriced IPOs,

investors are left holding the can. This should stop.

Tuesday, March 8, 2022

Will Russia’s Ukraine-war hurt us? India faces secondary impact from market reverberations: Financial express 8th March 2022

The Russia-Ukraine conflict has rattled the markets, and the level of uncertainty has increased at a time when the world economy looked poised for a recovery. The markets were looking at the Federal Reserve increasing rates multiple times with the rollback of QE. This optimism has gotten punctuated with this war. What does this mean for us?

The direct impact on India will be limited to the extent of the trade between the two nations. The share of Russia in India’s total trade is just about 1%, and would not make much of a dent. In fact, a large part of the imports are defence-related, where the government can work out ways to ensure that the deals carry on. It is, however, the indirect impact—through the markets—that is a major concern.

The first point of contact is inflation. Commodity prices have started rising since the verbal assault began in early February. Crude oil impact is probably the most obvious one, but the war has been pushing up prices of metals, gas, edible oils right when it was expected that prices would remain stable this year after a bull run in 2021. Interestingly, in India, manufacturers had started increasing prices and passing on the higher input costs gradually since late December. Now, with this fresh round of increase in prices, the pressure will build across the board. The Indian government had desisted from increasing the price of fuel products since November, keeping an eye on the state elections. This round of price increase was expected even without the war. The present circumstances only exacerbates the situation.

The second area of concern is the rupee. The start of the war has lent a high degree of volatility to currencies across the world. A combination of war and sanctions has led to currencies coming under pressure, and the rupee has not been spared. This comes at a time when the current account balance had turned deficit-wards and,with oil prices going up, a higher CAD can be expected.

FPIs were already jittery given the tenuous situation regarding the next move of the Fed. The present situation has made such investment fickle as there has been the usual case of flight to safety with the dollar and gold benefiting from the present tension. Normally, gold and dollar go in different directions, but this time, they are headed the same way.

Third, the higher demand for dollars has meant that bond yields have also turned volatile. Yields have been falling on expectations that the Fed may not go in for a rate hike under these conditions. But, signals indicating that this would continue as inflationary fears get even starker are driving rates up. Hence, the daily volatility in bond yields has kept markets guessing. In India, however, the direction is clear—upwards. Post the credit policy, it was believed that RBI would not go in for rate hikes this year. This made the 10-year bond revert to the 6.7% mark.

However, with the state elections coming to an end and the global price of crude moving towards the $120 mark, markets have been spooked. Add to this the fact that the government may just defer the LIC IPO means that there could be challenges on the financing of the deficit. This has pushed the 10-year bond to 6.85%. These constant yo-yo movements may be expected till there is more clarity on the intensity of the Ukraine situation.

Fourth, the payment issue has raised concerns for those dealing with Russia. With Russia being blanked out of SWIFT, exporters are in a quandary. Add to this the fact that shipping companies are reluctant to ferry goods to Russia. In an attempt to hurt Russia, all entities in different countries are affected as they are counter-parties to these transactions. At the government level, India can enter into a rupee-rouble agreement, but for the private players, receiving roubles for exports may not be that attractive.

Will growth slow down? While there is no immediate threat for an economy, which is driven by mainly domestic demand, the secondary impact through all these market reverberations will be felt on the economy. Higher prices will definitely come in the way of demand and consumption. High inflation will also pressurise the MPC to review its stance on policy as it cannot be passed off as being transitory. Higher interest rates will go with inflation and the currency will stay volatile.

RBI may have to go in for more of the sell-buy swaps to steady the rupee. Uncertainty and a modicum of turbulence will mean more central bank intervention at some point of time.

Sunday, March 6, 2022

LIC: The Big Bang IPO: Businessline 7th March 2022

The LIC IPO is probably the biggest event in the stock market which overshadows probably even the dream run of the Sensex which topped the 60,000 mark this year. One is the size of the issue, which is really big. The other is that LIC disinvestment project has been pending for long and had to be postponed due to the pandemic.

It is also a strong signal to the market that the government means business and can be seen as a follow up on what was announced during the Atmanirbhar series of reforms. It hence has sent feelers about other such disinvestment/privatisation plans.

The LIC is the largest life insurer and would probably continue to be the leader for several more decades, thanks to the inherent trust of people in the institution. It is not surprising that the embedded value of the enterprise has been put at ₹5.4 lakh crore.

Valuation arithmetic

Intuitively with a multiple of 3-4 times which is what is commanded by the other large insurance companies, the valuation could be in the range of ₹16-20 lakh crore. The final offering will be of interest and assuming that the government is disinvesting 5 per cent of the enterprise at a valuation of ₹65,000 crore (which is out of the ₹78,000 crore of revised disinvestment receipts in the Budget), the valuation could be at a very conservative ₹13 lakh crore.

This is allowing for the fact that the government would like to give upfront the investors a potential gain in the market beyond the multiple of 2.4-2.5 which is implicit here. This is what the rudimentary arithmetic of the IPO could look like.

The strengths of the company lie in having the first mover advantage. First being owned by the government is a big positive as it signals confidence.

Second, it has been run rather professionally which adds to the value of the enterprise. It has also been earning profits historically. Third, as a large part of its investments are in government paper, the portfolio is protected and there is a steady stream of revenue in future. Fourth, the company has large investments in equities of blue chip companies and give a high yield given that the purchases were reckoned in the past.

Therefore, there is every reason for retail investors to consider this IPO as part of their portfolio. As the pricing is expected to be reasonable and well spread out to policy holders there appears to be something for everyone.

Once done, this would be a landmark not just for the government but also the company. From the point of view of the government the next steps also need to be considered. Should the government keep divesting slices of the company till it reaches 51 per cent?

This is a logical question because from the point of view of both market and the government’s ideological stance. Selling LIC from an ideological point was to extract value from the enterprise in which case it cannot stop at 5 per cent and logically should move upwards towards 49 per cent after which the more challenging decision of letting go can be considered — maybe after a decade or so.

Investor interest

From the market perspective, if divestment stops at 5 per cent, interest in trading will come down. Therefore there could be a compulsion to keep divesting in parts to keep the stock attractive. It should be pointed out here that LIC as a company can be counted on giving steady returns over time with little volatility in earnings. This is the nature of the business and holds for all the leading insurance companies.

Unlike general insurance where a catastrophe like a flood can increase claims substantially, the same does not hold for life and the Covid pandemic clearly vindicates this view. Unlike a new age company, the life insurance business has very little volatility. Volatility normally creates investment opportunities and hence an insurance stock cannot generate this sentiment. Therefore it may be necessary to keep adding to the free float to keep interest alive.

Internally, the company’s mindset will change once it is listed. Currently being a government company, it was outside the radar of analysts, who have the power to nudge the entity to reorient its ways.

For the government the issue to be kept in mind is the future of disinvestment in general in the context of LIC. LIC has traditionally been the investor of last resort and in future such support will be scrutinised by the analysts as these investments become part of the projections.

In short, LIC will have to disengage gradually from the government’s disinvestment plans especially from deals which do not conform with market standards. This may not be an issue going by the government’s firm stance on privatisation or disinvestment for that matter. The way in which Air India was sold shows that certain bold decisions would continue to be taken if required.

Also the insurer will have to get into a “quarter-to-quarter” performance mindset, which is a feature of listed companies. The company will also be constantly compared with its peers, which is inescapable. Hence the market will be overly sensitive to every aspect of the business numbers and financials with the success of every scheme being evaluated with the benchmarks.

The same would hold for all the cost and productivity ratios and hence LIC would be under the radar forever. While this task is not unsurmountable, there would have to be necessarily a change in mindset until such time it becomes a part of the DNA. But LIC, given its stature, will adapt to the new situation quickly.

The LIC IPO is likely to be a success (assuming that the Russia-Ukraine war eases in the next couple of weeks), and will lay the roadmap for all other disinvestment proposals too in the years to come. Will this be a one-off exercise, or the first in a series remains to be seen.

Friday, March 4, 2022

The confusing case of India's GDP data: Economic Times 5th February 2022

The

second advance estimates (AE) on GDP were

released on February 28, while the first AE on January 12. The revised

estimates (RE) for FY2021 came out on January 31. There is excitement each time

these numbers are released, quite like when the Monetary Policy Committee (MPC)

minutes are released - although for the latter, there are diminishing returns,

as most of the views of the members are known in the interim period. In any

case, does what each MPC member feels really matter once the outcome is

announced in the policy? Since by the time the MPC minutes are out, one gets

ready to debate the content of the next policy and, to quote John Maynard

Keynes, when facts change, people change their minds.

Coming back to the National Statistical Office (NSO)

and GDP, the logic of these advance and revised estimates is baffling. First,

the January 7 release of first AE for FY2022 is based on data that is available

up to November for most components. This means that a call is taken in four

months, with caveats like the impact of omicron not considered. So, what

purpose is served? Answer: this is the basis for the edifice of the Union budget brought out on February

1. So far so good.

The next release - the first RE for FY2021 - comes out on January 31. This is

for the past, and should ideally pass by like idle wind. But that's not so,

since the calculators are out and everyone is busy calculating how FY2021

finally turned out to be. And this time we got to know that growth, instead of

falling by 7.3%, fell by only 6.6%. It is supposed to mean that the economy did

better. Which means that growth for FY2022 that was supposed to be 9.2% 24 days

back is now actually down to 8.8%. Not because the economy slumped in this

period, but because FY2021 was better than one thought. This is the infamous

'base effect'.

This base effect is often trotted out as a reason for anything that happens for

which we can't find an explanation. Therefore, even while we pay high prices

for our vegetables in the market, negative inflation is explained by the base

effect.

The Union

budget, which is preceded by the Economic Survey, still talks of 9.2% growth in

FY2022 based on the 24-25-days-old story, because the January 31 RE comes out

after the Economic Survey is published. Hence, there is confidentiality, as the

NSO does not let out the numbers to the Department of Economic Affairs (DEA),

which brings out the Economic Survey. But the budget uses the 9.2% to project

the FY2023 GDP growth rate and

accordingly fixes the fiscal deficit ratio.

Next, the RBI comes out with its policy on February 10 and still sticks to the

9.2% growth number for FY2022 to extrapolate the FY2023 number, which is put at

7.8%, The spreadsheets are out again on what the RBI estimate would be in case

it used 8.8% as the growth number, which is the real rate after January 31,

after all.

And just while we are digesting these numbers, there is a second AE for FY2022,

which comes out on February 28 that now says with more certainty that growth

will be 8.9% - which is closer to what the economist's calculator showed post 6

pm on January 31 and lower than the 9.2% that the Survey and RBI spoke of.

But wait. Here, too, the data does not take the January performance of

industry. Instead, it uses other imputations. This means we are still lagging

by three months.

Welcome to the world of Indian real time statistics. It is nothing short of

mind-boggling, keeping economists and statisticians awake for two full months.

We need to simplify everything and not have a plethora of estimates that

confuse. The sequencing of data is important. Why not have the RE for FY2021

first and then the AE for FY22? The latter is needed to ensure that the budget

has a chronological basis.

The second AE can be done away with, and we can have the provisional estimates

that come out normally on May 31 as the next touchpoint. While such a flow of

data keeps economists excited and fills TV airtime and newspaper space, is it

really worth it?