The present war in Ukraine has meant one thing for sure. We all have to suffer more on account of commodity prices going up with the impact being direct for petrol and diesel.

The issue is that even before the warlike situation began, there was a case for the government to naturally increase these prices because of higher global crude prices. These hikes were held back because of the State Elections that were to be held in February and March.

As was the case last year, once the results were announced, prices were increased. Why should it be any different this time? The government earns a lot of revenue from excise and VAT on these two fuel products. In Fy21 for instance, the centre picked up Rs 4.20 lakh crore while the states got Rs 2.17 lakh crore. In fact, this is one reason the government is not willing to include them under GST.

The centre in November did lower the excise duty rate by Rs. 10 on petrol and Rs. 5 on diesel. This was a reversion to the pre-pandemic times. Since November, the price of petrol has remained unchanged in Mumbai at Rs. 109/litre approximately.

Now given that the price of the Indian crude basket has gone up from $ 89.34/barrel in November to say $ 110/barrel in March if not more; what would be the price of petrol under unchanged conditions?

This would mean that the excise rate remains at Rs 27.90/litre as does the commission at Rs 3.77/litre and the effective VAT of 37.5% in Mumbai. Russia is the third-largest producer and supplier of oil and any ban on imports will affect overall supply as the other nations cannot provide around 11 mn barrels a day which is what comes from here. US and UK have spoken of such a ban.

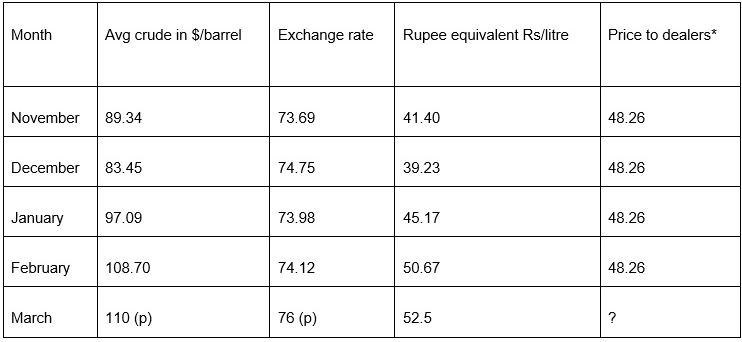

The table below gives the price of crude oil, exchange rate, price to dealers for the last 4 months. The same is projected for March under the new conditions:

P: Projected *: Cost held constant as the burden has been taken on by OMCs. The price to dealers should ideally have been Rs. 6.86 higher than the rupee equivalent in the table which is the refining cost calculated as the difference between the rupee equivalent of crude price and the price to dealers. Based on this, the cost per litre would work out to the following:

The table shows that if the price of crude remains at $ 110 for March and the Rs/$ rate at 76, the cost to the producer will increase from Rs 48.26 to Rs 59.36/litre which is an increase of around Rs. 11.

The centre’s excise rate is a specific duty and the call has to be taken on whether to lower it further. Presently, the state VAT is around Rs. 30.80 which will increase by around 10%.

Which of the two governments will cut their tax rates? The centre is already in a quandary as the disinvestment programme will probably not be advanced this month given the market conditions. Therefore, there will be a deferment of the same next year for which Rs. 65,000 crore has been separately budgeted assuming that LIC would happen in FY22.

The market will not be prepared for Rs. 1.3 lakh crore of disinvestment next year and hence the move has to be calibrated. The centre has already budgeted for a lower collection on the excise front which is charged mainly on fuel products.

This was lower than FY22 by Rs. 60,000 crore as the duty was cut on fuel in FY22 itself. Any further reduction in duty will widen the revenue-expenditure gap further.

The states too have a tough job balancing their budgets and with the GST shortfalls being there for two successive years and the uncertainty of the compensation post FY22 when the GST had given the assurance, any cut in VAT here will pressure their budgets further.

Therefore, this will be a very tough call to take by the government. States which have a more comfortable position in terms of fiscal space may be in apposition to lower the VATrates but this will help to lower the overall price, which will still remain above the current levels.

If the taxes are not touched,then the price of fuel will rise which will be inflationary not just from the point of view of the fuel component but also freight rates which will in turn then find their way through other commodity prices thus leading to generalized inflation. If the same is absorbed by the OMCs, then the government has to be prepared for lower dividends from these companies.

Therefore,it will be interesting to see how the two governments respond post the State Elections assuming that the crude oil prices remain in this elevated range.

No comments:

Post a Comment