A suggestion which is made by almost everyone to the government is to increase capex allocation in the Budget. In FY23 the government had budgeted for ₹7.5 lakh crore which was roughly 19 per cent of total outlay. In FY22 it was around 16 per cent. Is this really a panacea for our investment problem?

In FY22, total gross fixed capital formation was ₹68 lakh crore and Centre’s capex was ₹6 lakh crore. Can ₹6 lakh crore of funding drive ₹68 lakh crore of capital assets? A lot of government capex is actually carried out by private players, with the former acting as a financier, generating a stream of downstream investments. Despite this interdependence and the prevalence of PPP funding, government capex cannot replace private investment; it can only supplement it. Hence when there is a clarion call from India Inc to the government to increase capex, it indicates some helplessness on the part of the private sector to perform its role.

In fact, if the overall allocation of ₹7.5 lakh crore of capex for FY23 is looked at closely, some interesting insights can be obtained. This includes ₹1.11 lakh crore of transfers to the States which in turn also show a similar amount of capex. States normally have budgets for capex of an equivalent amount as the Centre; and in FY22 ₹6.67 lakh crore was targeted as against ₹5.54 lakh targeted by the Centre.

Govt, a catalyst

Governments, it should be remembered, provide finance for specific projects like roads or railways or irrigation. For the Centre, of the balance ₹6.4 lakh crore that was to spent in FY23, defence (₹1.52 lakh crore), roads (₹1.88 lakh crore), railways (₹1.37 lakh crore), telecom (₹0.54 lakh crore) and housing (₹0.27 lakh crore) accounted for ₹5.58 lakh crore. Therefore, the canvas for big ticket investment is restricted to five sectors.

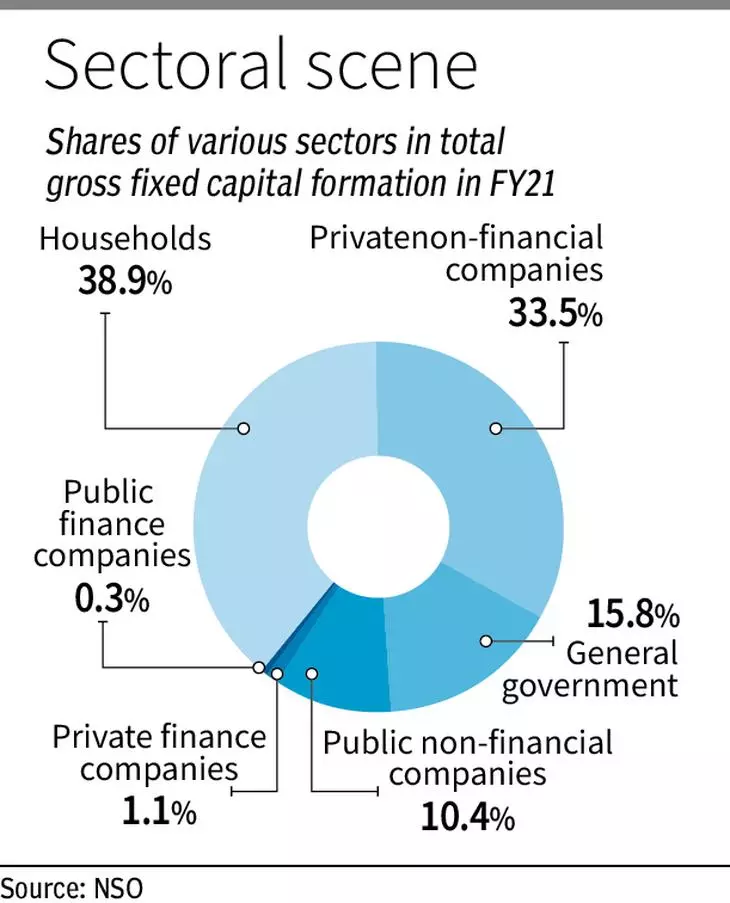

Quite clearly the heavy lifting for capex has to come from the private sector, led by corporate India. The NSO data for FY21 is useful here where the contribution of various sectors can be gauged for gross fixed capital formation. The table gives the shares of various sectors in total gross fixed capital formation in FY21. There are indications that the share of SMEs in capital formation, included in the household component in the NSO data, has taken a hit on account of the Covid impact.

There is therefore a need for the private sector to ramp up its investment. In 2015-16, that is just before the NPA issue surfaced post AQR, the share of private non-financial companies was as high as 40.3 per cent. This position has to be restored, but that is perhaps easier said than done.

The first reason for that is private sector investment in infrastructure has slowed down substantially with funding as well as risk aversion being the two main factors. Profit margins have taken a hit in the wake of commodity inflation. Banks have preferred to cherry pick their customers and changed focus to retail lending. At the same time companies evaluated risk before venturing into areas like power or telecom.

Besides, consumption has not been growing at a fast pace to improve capacity utilisation rates which is required for fresh investment to be considered. Capacity utilisation rates have been capricious. After peaking at 75.3 per cent in March 2022, it has dipped again to 72.4 per cent in June 2022 going by RBI data. It does look like that investment has been more sector specific rather than broad based. The environment has to change.

The PLI scheme

The government has been pragmatic on the PLI scheme which has an outlay of ₹2 lakh crore spread over around 15 sectors. The idea is to enthuse them with incentives of 4-6 per cent of value of turnover provided certain norms on investment and turnover are met. The response has been good in terms of applications and intention and it needs to be seen as to how much of this fructifies given that there are time lines of at least three years provided for most of the sectors.

The other issue with government capex is that while the Centre is able to largely meet its commitment because it is not bound by a sacrosanct fiscal deficit number, States do not have such liberty. States tend to wait and watch till the end of the year before putting in their money. The reason is simple. As the fiscal deficit ratio of 3-3.5 per cent is something that cannot be compromised, if revenue pick up is slow, they tend to cut back on capex which is the discretionary element in the budget.

In FY21 for example, States had budgeted for ₹5.98 lakh crore of capital outlay but ended up spending just ₹4.59 lakh crore mainly due to the fiscal constraints.

Hence while there is a lot of attention paid to government capex, the core issue being missed is the role of the private sector here. The low interest rate regime especially in the Covid years helped the government keep its cost of borrowing down, which helped in capital formation. The response of the private sector was weak on this score though admittedly the uncertainty in the economic environment hindered the revival of animal spirits.

Government capex can hence be a good starting point for roads for instance but for manufacturing and other infra segments like airports, ports, power, telecom, the private sector has to take the lead to have an impact. The economy has to get back to the ratio of 33-34 per cent of GDP for gross fixed capital formation. Banks are in a better shape to provide finance, now that the books have been cleaned up.

But the real push has to come from India Inc.

No comments:

Post a Comment