The Ukraine-Russia war followed by sanctions has had an interesting fallout — the opening of doors for foreign trade in local currency. Today, most foreign trade is in internationally accepted currencies like the dollar, euro and pound followed by yen and probably a bit of yuan and Swiss franc.

Recent IMF data on global holdings of forex reserves suggest that 60 per cent is held in dollars, followed by 18-20 per cent in euro, about 5 per cent each in yen and pound, and 3 per cent in yuan among others. Trade would broadly follow this pattern.

The idea of trading in domestic currency germinated against the backdrop of sanctions imposed on Russia. This was accompanied by impounding of its forex reserves held in dollar assets. As a further top-up, payments to Russia was banned from the SWIFT (Society for Worldwide Interbank Financial Telecommunication) system. As most payments go through SWIFT, dealing with Russia became tough. Sanctions have, however, been different this time with energy being virtually excluded — unlike in the case of Iran where the US had retribution clauses, the present situation does not carry such a threat.

Trade still carries on with Russia with payments being made through third parties, which is also common when commodities are dealt with globally; trading houses specialise in channelling payments and settling trades across countries. In this situation it makes sense for India to look to have rupee trade agreements with its partners.

The idea is not new but has been resurrected in the present situation. Essentially, this means that if we have a rupee rouble trade agreement, we would pay for imports in rupees converted to roubles and Russia would do so for their imports in rupees with the exchange rate being determined by a market factor. Sounds straightforward, but there are questions to be answered.

Rupee-rouble pact

Typically, two countries run either a deficit or surplus with the other. Therefore, one country will end up getting more of the other currency. The issue is whether it can be used elsewhere. While India imports more from Russia and will be paying rupees, the same cannot be used by Russia to buy goods from other countries. This is why we need hard currencies for foreign trade.

Any possibility of such trade must necessarily address this issue where domestic currency is used by the counterparty to settle transactions with a third party. This was also the context when experts have spoken on internationalisation of the rupee.

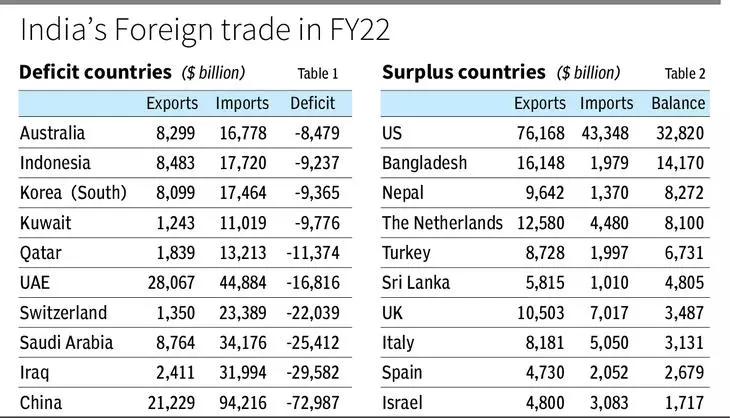

India is exploring having such agreements with various countries. Intuitively, it would work with countries where we run deficits, because if we are importing more than we export and pay in rupees, then that would be to our advantage. The table below gives the top countries with whom we run a trade deficit. As can be seen, in FY22 the cumulative deficit was around $230 billion for these 10 countries. If India is able to breakthrough with rupee trade with some of them, it would help in conserving forex. Five of these are oil supplying nations with around $90-95 billion of deficit.

The question is whether or not a rupee arrangement will work with any of them. Hypothetically, if Australia were to agree to rupee-Australian-dollar trade, they would end up with surplus rupees that cannot be used for trade with other countries. Therefore, a group of countries is needed where members are willing to accept each other’s currencies.

The table below gives the list of the top countries with whom we had a trade surplus. Interestingly we have the biggest surplus with US which helps in bringing in dollars in net terms for us.

The other countries with which we have considerable surplus are Bangladesh ($14 billion), Nepal and Sri Lanka (cumulative $13 billion). Here, while rupee trade would be acceptable, the question is whether we would be willing to accept takas.

A broader issue one needs to look at when considering rupee trade is — while it would be possible to group countries with similar mindsets and have Indian rupees being used within the closed user group, this would also mean that there would be less flow of dollars and other hard currencies.

Currency bloc

Are we prepared for this? Therefore matching of countries is important, involving a mix of both the countries with whom we have surplus and deficit. Bangladesh may find it well to deal in domestic currencies but we will be losing out on the dollar surplus of say $14 billion as per the table which would go into the pool of dollars that finance imports from other countries.

Ideally, having rupee agreements with oil exporting countries will help to ease pressure on foreign exchange and hence India can work towards forming a currency bloc with the Gulf countries where the surplus rupees received by them will be used for trade within the group.

The need to have trade in domestic currencies is compelling because US will be using the tool of sanctions against countries that it believes are going wrong on the political side. This can lead to also putting an embargo on dealing through SWIFT, the international clearance system for currencies. The Russia-Ukraine conflict exposes these vulnerabilities for the rest of the world. There is also the fear of dollar assets kept in US being frozen. Hence the Russia episode causes nations to think harder. This will be high on the agenda for 2023.

No comments:

Post a Comment